LiquidiumWTF

LiquidiumWTF is a peer‑to‑peer lending solution that lets Bitcoin holders lend and borrow BTC against on‑chain collectibles such as Ordinals, Runes, and BRC‑20 tokens. Every loan settles natively on Bitcoin L1—no wrapped assets, bridges, or side‑chains.

Since launch, LiquidiumWTF has seen rapid adoption and usage, emerging as one of the leading lending protocols for Bitcoin-native digital assets.

Cumulative metrics as of July 2025:

- > $500 million in total loan volume

- > $9 million in interest paid to lenders

- > 100,000 loans processed

These numbers reflect strong demand for Bitcoin-native lending and show how removing manual counterparty friction can unlock real liquidity and utility for both lenders and borrowers.

What makes this possible are the threshold‑signature protocols of the Internet Computer. Lender funds are held in a 1-of-2 multisig vault, where one signer is the lender and the other is a smart contract running on ICP. This contract can generate ECDSA or Schnorr signatures on demand, effectively co-signing on behalf of the lender.

When a loan offer is matched, the smart contract immediately co-signs both the collateral-lock and principal-release PSBTs. This eliminates the need to wait for a manual counterparty signature, enabling real-time execution and turning idle BTC into productive capital.

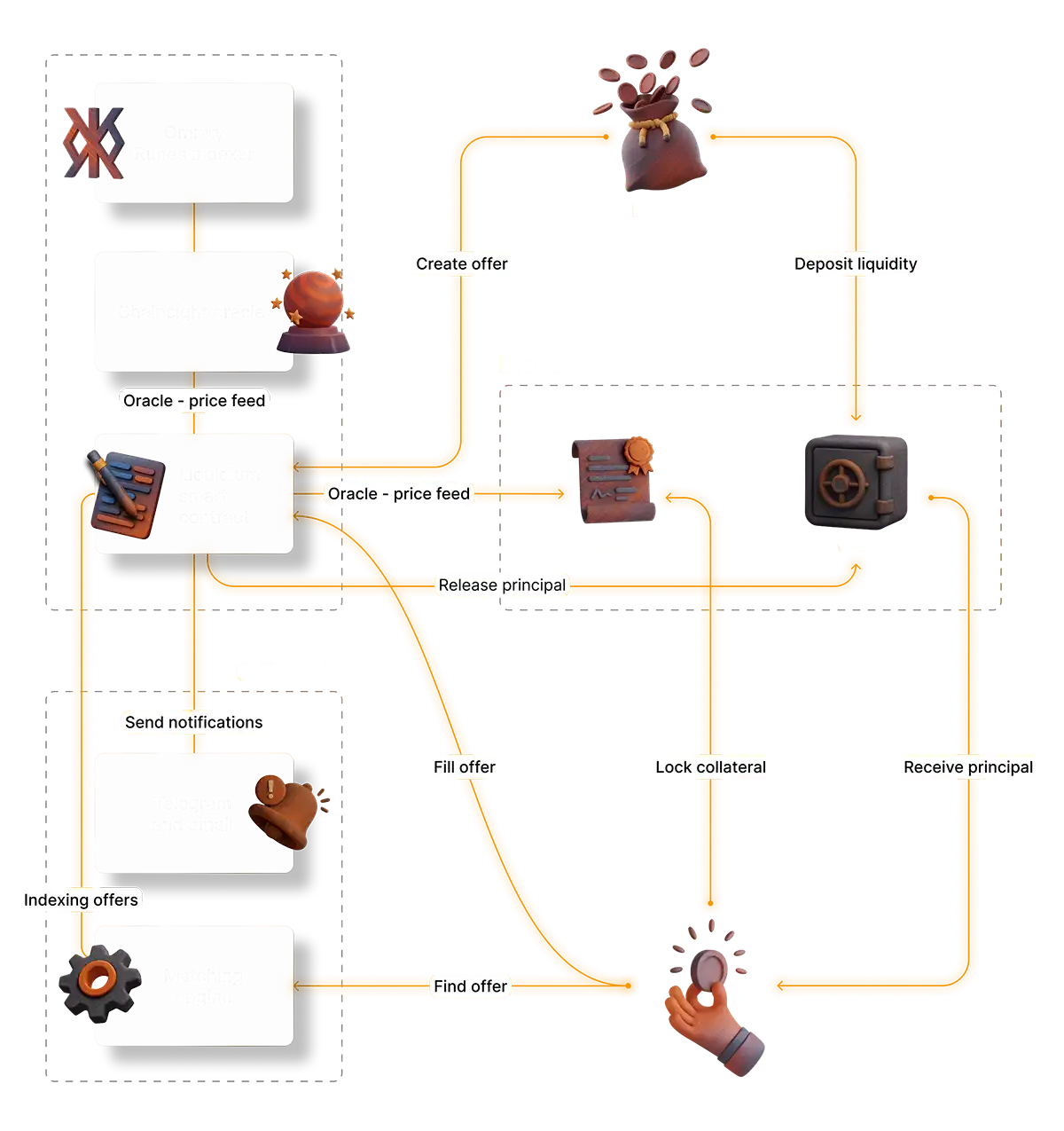

Lender Flow – Creating an Offer

Fund the vault: Lenders deposit liquidity to their personal vault address. This address is a 1‑of‑2 multisig, so the lender can always withdraw funds independently. The LiquidiumWTF smart contract may only release funds when an offer has been filled.

Define terms: Lenders create loan offers from the vault balance, specifying the amount, duration, interest rate, and initial / maximum loan‑to‑value (LTV). The max‑LTV acts as a safety mechanism: if the collateral value drops below this threshold, the offer is automatically paused.

Borrower Flow – Filling an Offer

Match an offer: Borrowers interact with an off‑chain matching engine to find loan terms that meet their needs.

Lock collateral: The borrower submits a PSBT (partially signed Bitcoin transaction) that moves their Ordinal / Rune / BRC‑20 collateral into an escrow script.

On‑chain checks: The LiquidiumWTF smart contract verifies that the PSBT meets the offer terms. Reliable price feeds for the collateral are provided by ICP-based projects Chainsight and Omnity.

Instant execution: Once validated, the smart contract co‑signs and publishes both the collateral‑lock and BTC principal‑release transactions. BTC is released to the borrower and collateral is locked.

Automated Repayment & Default

- Repayment: When the borrower repays the loan with interest, BTC is returned to the lender's vault and the collateral is released back to the borrower.

- Default: If the loan is not repaid in time, the smart contract automatically transfers the collateral to the lender's wallet.

Summary

LiquidiumWTF is a strong example of how Bitcoin-native lending workflows can be enhanced through the Internet Computer’s capabilities—without compromising user custody or introducing synthetic assets. By building on features already present in Bitcoin, such as multisig wallets and PSBTs, LiquidiumWTF creates a seamless peer‑to‑peer lending experience that feels anything but clunky.

The platform’s smart contract acts as a neutral co-signer, allowing borrowers to access just a portion of a lender’s liquidity while using fractionalized assets as collateral—something difficult or impossible to coordinate in traditional peer‑to‑peer setups. This innovation removes a significant coordination bottleneck, making smaller and more flexible loans feasible.

Additionally, the architecture leans on deterministic on-chain logic and automated price verification via oracles, enabling trust-minimized execution. These building blocks—multisig vaults, partial liquidity fills, automated collateral verification, and instant co‑signing—come together to form a lending platform that is faster, more flexible, and more accessible than traditional P2P models.

For developers exploring Bitcoin DeFi, LiquidiumWTF serves as a compelling case study. It highlights how existing Bitcoin features, paired with ICP’s programmable signing and smart contract automation, can unlock entirely new types of lending products.